1Q results are out and figures came in much better than expectations as the firm recognizes more revenues from completed projects.

Please note I do not typically track firms by the quarters but this note is to double check on the investment and to ensure that the original thesis that the previous operating results were just average holds.

- Revenue up 60% while profit rose to 42%

- $121.7m of $149.6m or over 81% in properties for sale under development are sold

- The increase from $131.5m in dec 09 was due to purchase of site at Lorong 102 Changi

- Short term debt of $160.42m and long term debt of $96.06m. Total $256.48m

- $72.6m of short term debt will be repaid by March 2011 upon TOP and collection

- And if you worried why net debt to equity was high...bulk of cash is locked up in project accounts

- Assuming firm earns $30m in 2010 (likely to be much higher), they would need approx over 2.7 years to pay back the debt which is perfectly reasonable and in fact on the low side for developers

- Firm remains adopting FRS 16, hotel is still at cost less depreciation/ impairment

- Property devt is 82% of total revenue

- "The Ambra" TOP is in March 2010

- Revenue recognized from 9 projects, Azzuro, Verte, Adara, Ambriosa Ambra, Florentine, Nova 48, Nova 88 and Lucent

- Hotel and property investment is 18% of total revenue

- Hotel AOR improved from to 82.4% to 93.5% yoy (13% rise)

- Hotel ARR declined $167.2 to $151.8 yoy (9% decline)

- Revpar up $137.8 to $141.9 (3% rise)

- Gross margins wise, property devt made up 55%, rest from hotel and investments

- Hotel margins flat while devt declined due to recognition of lower margin projects

- Intention to launch 4 out of 7 current plots of development sites in 2010

- Revenue will approximate $325m for the rest of 2010

- Firm's intrinsic value remains intact

- Note revaluation surplus was not added to income statement under FRS16

- Value of hotel declined a little due to depreciation, hence increasing the revaluation surplus

- Still a deeply undervalued counter with favorable risk reward ratio

- RISKS

- Downside is very low

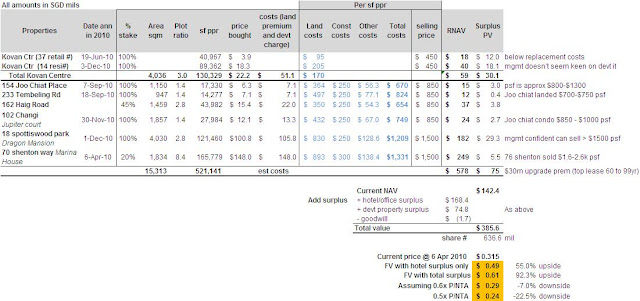

- Assuming 0.5-0.6x NTA (book value + hotel RNAV), downside is 7-22.5%

- Upside taking into hotel only is already 55%

- Management is very transparent and communicates their thoughts through the quarterly reports, recently gave a dividend of S$0.01

- I suppose the fear lies in inability of firm to replenish landbank and control margins

- Dont forget...

- you are buying it at less than the hotel value alone (gives only 45% of gross profits)

- Singapore residential real estate remains robust, in fact improved over last quarter

- Significant improvements in hotel segments and embedded value in Kovan center

- I will look to buy more in the coming weeks

Disclaimer: The writer is vested in this counter

1 comments:

Nice companies

Post a Comment